Community Contributions to Education or Training of one Spouse

Under What Circumstances is The Community Reimbursed for Community Funds Used to Pay for the Educational Expenses of One Party?

California divorce law provides for reimbursement plus interest to the community if community funds were used for the education and/or training of one spouse – in limited situations.

The community estate may be reimbursed for community contributions, to the cost of the education or training of a spouse that substantially enhanced that person’s earning capacity.

An exception to the reimbursement exists where:

- The parties agreed, in writing, to no reimbursement

- The community contributions were for ordinary living expenses that would have been incurred regardless of whether or not the party was attending school

If an educational loan is outstanding at the time of the divorce, it is assigned to the spouse without offset unless there is a written agreement to the contrary.

The court has the discretion to reduce or modify the statutory reimbursement and assignment of educational loans to the extent circumstances render such a disposition unjust for any of the following reasons:

- The education or training enables the spouse to engage in gainful employment that substantially reduces the need of the party for support that would otherwise have been required.

- The education or training received by the spouse is offset by the education or training of the other spouse.

- When the community has substantially benefited from the education, training or educational loan.

Rebuttable Presumption

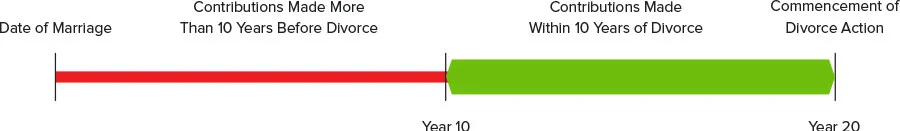

There is a rebuttable presumption that the community has substantially benefited if the community contributions were made more than 10 years before the commencement of the divorce action and a presumption that the community has not substantially benefited if they were made within 10 years of the commencement of the divorce action.